Manufacturing is a large and important part of the Tucson economy. It generated 27,830 jobs and 13.8% of GDP in 2019. Wages were also high in this sector, at an average of $92,786 per worker, which was $22,866 above the national average. Transportation equipment (aerospace and defense) was by far the largest manufacturing sector in Tucson in 2019, accounting for one-half of local manufacturing jobs.

The pandemic has impacted all sectors of the Tucson economy, including manufacturing. Reduced economic activity globally decreases demand for most manufactured goods, including those produced in Tucson.

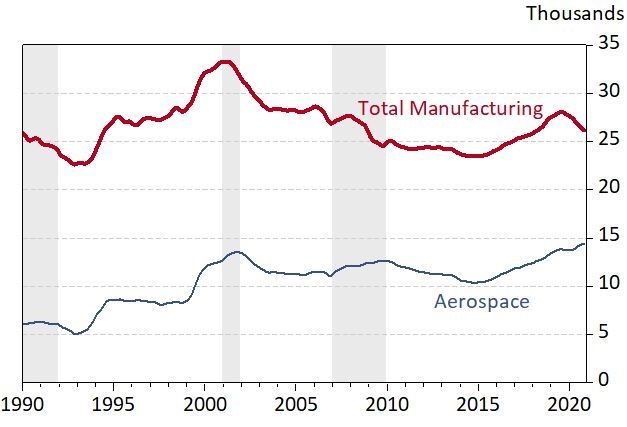

Prior to the pandemic, Tucson’s manufacturing employment had been trending up since 2015. This does not appear to have been driven by recent tariff increases (which began later). Instead, it appears to have resulted from an increase in aerospace manufacturing jobs, which tend to be sensitive to defense spending.

For more on the impact of recent tariff increases on Tucson’s manufacturing sector, see the Impact of Trade Wars on Manufacturing Employment.

The pandemic is also likely contributing to shortening supply chains for manufacturers, which may mean the relocation of some production from Asia to Mexico, Canada, and the U.S.

Finally, the pandemic is increasing the incentives of producers to invest in automation. This will continue to transform methods of production in the future, just as it has in the past. Overall, Tucson manufacturing jobs tend (on average) to be less exposed to automation risk than the national average. That is because research and development, which is hard to automate, plays a large role in local activity. However, the local manufacturing workforce will collaborate with machines and artificial intelligences more in the future than they have in the past. For more on this topic, see Impacts of Automation on Pima County Employment.

Let’s delve into the data on the role of manufacturing in the Tucson economy.

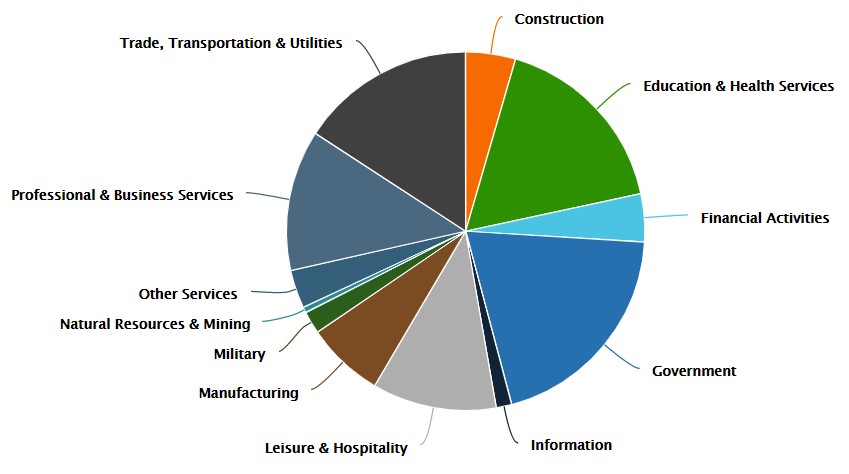

Figure 1 shows that manufacturing jobs were an important part of the local nonfarm payroll job mix (including military jobs) in 2019. Manufacturing jobs accounted for 7.0% of all jobs in Tucson. That ranked manufacturing the sixth-largest NAICS supersector, behind government (19.9%); education and health services (17.1%); trade, transportation, and utilities (15.8%); professional and business services (12.7%); and leisure and hospitality (11.2%).

Manufacturing jobs make up a larger share of total employment in Tucson than statewide (6.0%) but a smaller share than nationally (8.4%) in 2019.

Figure 1: Tucson MSA Industry Employment Shares in 2019

While manufacturing is a major employer in Tucson, it is important to keep in mind that jobs understate the relative importance of the industry. That is because productivity gains often generate output growth with less than proportionate increases in jobs.

A better measure of the direct importance of the industry is available from estimates of Gross Domestic Product (GDP). GDP is a measure of the value of goods and services generated by labor and property located in a geographic area.

Figure 2 shows industry shares of GDP in Tucson and the U.S. by NAICS supersector for 2019. Manufacturing accounted for 13.8% of Tucson’s GDP, which ranked the industry third, following financial activities (21.7%) and government (18.3%).

Tucson’s manufacturing share exceeded the national share of 10.9% in 2019.

Figure 2: Industry Shares of GDP in 2019

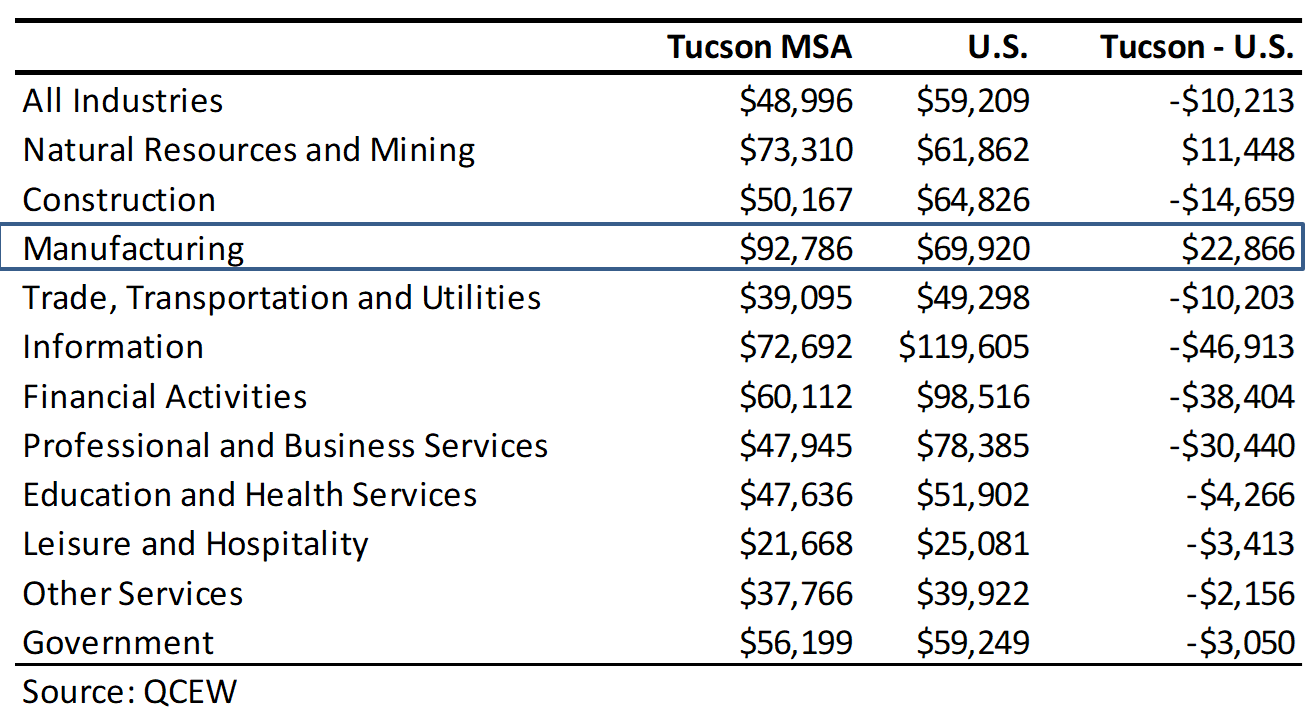

One reason that manufacturing GDP made up a relatively large share of Tucson’s GDP in 2019 was because manufacturing wages were relatively high compared to other sectors. Exhibit 3 shows wages per worker by NAICS supersector for Tucson and the U.S. in 2019. Wages per worker are measured using data from the Quarterly Census of Employment and Wages.

As the figure shows, wages per worker for all industries in Tucson were $10,213 below the national average. That was a 17.2% difference. Among the 11 NAICS supersectors, manufacturing posted the highest wages per worker at $92,786. That was $22,866 above the national average (32.7% higher). Note also from the exhibit that manufacturing and natural resources and mining were the only supersectors with wages per worker above the national average in 2019.

Figure 3: Tucson MSA and U.S. Wages Per Worker in 2019

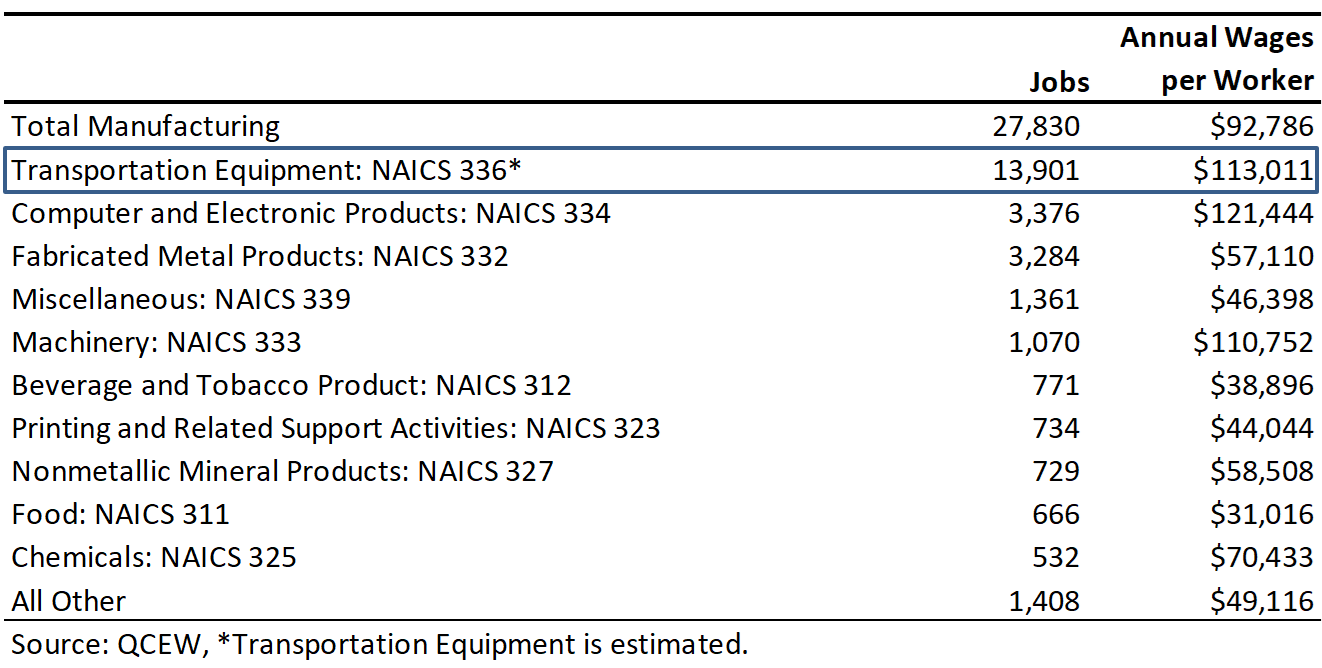

Manufacturing is a broad category that includes many different types of activities. Which detailed industries generated the most jobs in Tucson? Exhibit 4 breaks out manufacturing jobs and wages per worker in Tucson by the largest three-digit NAICS sectors. As the figure shows, transportation equipment (NAICS 336) was by far the largest employer, with an estimated 13,901 jobs in 2019. That was 50.0% of all manufacturing jobs. Transportation equipment includes jobs in aerospace and much of local defense manufacturing. Next largest employers were computer and electronic products (3,376), fabricated metals (3,284), miscellaneous (1,361), and machinery manufacturing (1,070).

Figure 4 also shows that the three highest paying sectors in 2019 were computer and electronic products; transportation equipment; and machinery.

Figure 4: Tucson MSA Manufacturing Jobs and Wages Per Worker in 2019

Figure 5 shows trends in Tucson total and aerospace manufacturing jobs. Note that total manufacturing jobs locally trended up beginning in 2015, driven in large part by strong gains in the aerospace sector. Thus, manufacturing jobs were already trending up before recent tariff increases. Further, it is unlikely that tariffs contributed to the increase in aerospace jobs, which are more sensitive to developments affecting overall defense spending.

Manufacturing job gains have weakened during the pandemic, likely reflecting reduced demand for non-aerospace goods.

Figure 5: Tucson MSA Manufacturing Employment Trends, Smoothed