Examine Outdoor Recreation Trends in Tucson, Arizona MSA

Examine Outdoor Recreation Trends in Tucson, Arizona MSA

How are we doing?

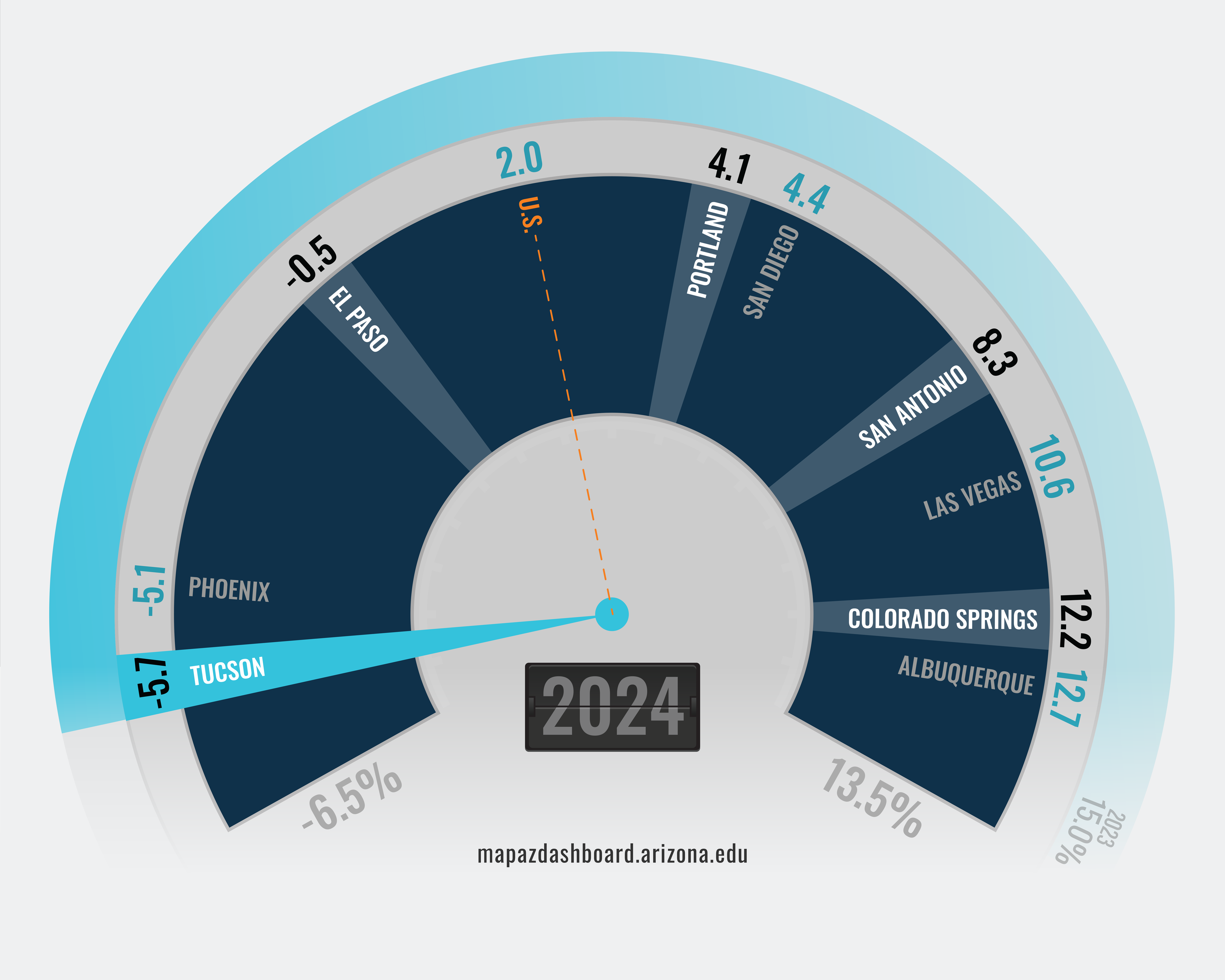

Annual Growth Rate of National Park Visits by MSA (2024)

*There are no national parks in the following Metropolitan Statistical Areas (MSAs) tracked on the MAP: Austin, Denver, and Salt Lake City.

In 2024, national parks located in the Tucson MSA had 1,128,981 visitors. That was a decline of 5.7% in national park visits from 2023, or a loss of 68,526 visitors. Tucson growth in national park visits ranked last in 2024 compared to peer MSAs. Nationally park visits were up by 2.0%, and the state of Arizona posted an increase in visitors of 4.1%.

Why is it important?

Outdoor recreational land provides neighboring communities with direct social and economic benefits. Scenic views, outdoor recreational opportunities, and open space have been linked to amenity-driven economic development, increased real estate values, and positive public health outcomes. Moreover, recreational land and outdoor leisure opportunities attract visitor spending, which in turn serves as an important input to local retail and service sectors. One study has estimated direct spending due to tourism at $19 billion in Arizona during 2012, supporting approximately 160,000 full-time equivalent jobs statewide.

How do we compare?

In 2016, federal recreational land covered 29.0% of the Tucson Metropolitan Statistical Area (MSA), ranking it fifth among 12 western MSAs. The Las Vegas MSA ranked first with 85.2%, and the San Antonio MSA ranked last. In Texas, three MSAs had less than one percent of their area held as federal recreational land. The Tucson and Phoenix MSAs both have a slightly higher percentage of federal recreational land than the nation as a whole.

What are the key trends?

The growth rate in national park visits in the Tucson MSA was down by 5.7% in 2024, which resulted in a substantial decline in visitors from 2023. Overall, the two national parks located within the Tucson MSA (Saguaro National Park and Organ Pipe Cactus National Monument) had 1,128,981 visitors in 2024. The decline in national park visits in the Tucson region in 2022 and 2024 was less than during the early part of the pandemic. Many national parks were partially or fully closed in 2020 due to the coronavirus pandemic. The state of Arizona and the nation fared better than Tucson in park visits in 2024.

Over the long term, Tucson has seen volatility in park visits, with rates increasing during periods of economic growth and decreasing during the prior recession. Following the Great Recession, Tucson and Arizona experienced five years of growth in visits to national parks located nearby.

Interested in learning more about tourism trends in Arizona? Check out the Tourism and Travel page on EBRC’s Arizona’s Economy online magazine. Looking for data on international tourism trends? EBRC’s Arizona-Mexico Economic Indicators site has the latest indicators on Arizona-Mexico Tourism.

How is it measured?

The percentage of federal recreational land is computed by dividing Type A, B, and C federal lands by total land area for a geography. Type A lands include National Park Service, Fish and Wildlife Service, and Forest Service; Type B includes Wilderness Areas; Type C includes Bureau of Land Management and other Forest Service lands, as well as Oregon and California Revested Grant lands (OLM). Data are courtesy of a 2019 Headwaters Economics report. While aggregate land-use totals are accurate estimates as of 2016, data releases by agencies vary. Percent change in National Park visits is computed from National Park Service (NPS), Integrated Resource Management Applications (IRMA) Visitor Use Statistics, which are published annually.