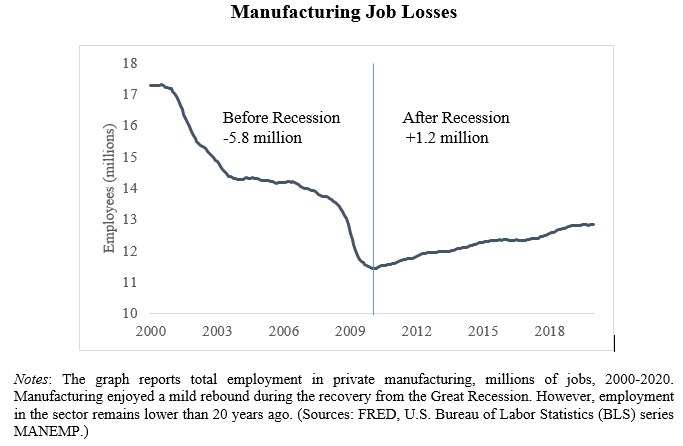

The Trump administration made headlines when it increased trade barriers in 2018 and 2019. Those tariffs—the largest in over 75 years—are designed to help America’s ailing manufacturing sector. The U.S. lost 5.8 million manufacturing jobs between 2000 and 2010.1 And, since the Great Recession, only 20 percent of those losses have been recovered. The White House argues that trade protection will help reboot American production and send workers back to the factories.

However, not everyone agrees that tariffs work. Most economists—along with many prominent American industry organizations—argue that trade protection does more harm than good. Thus, there is a debate over whether trade wars are a good idea.

This report asks whether tariffs help U.S. workers. It focuses specifically on the U.S.-China trade war and on America’s manufacturing sector. This is because China and manufacturing have been the focal points of President Trump’s rhetoric and policy.

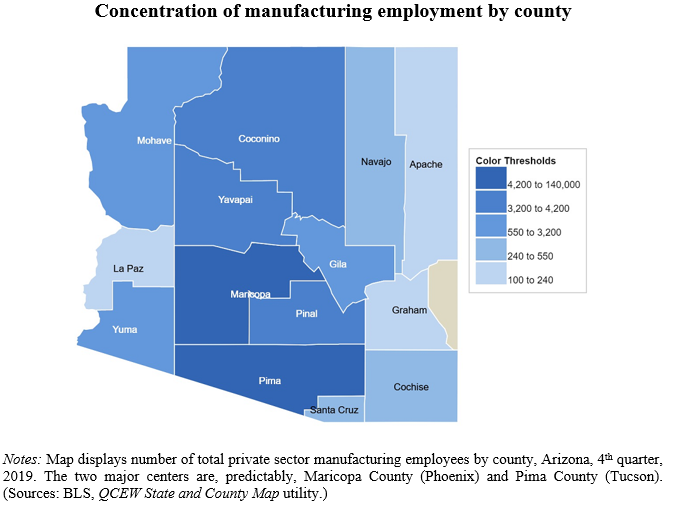

This study collects fine-grained data on the specific industries subject to trade protection in America. It then assesses whether tariffs on those products had any effect on import levels, employment numbers, or wage growth. It looks at national trends and then turns specifically to Arizona and Pima County.

Key findings include the following:

Import penetration is not a strong predictor of either job loss or wage stagnation. Rather, imports could be a sign of a thriving industry.

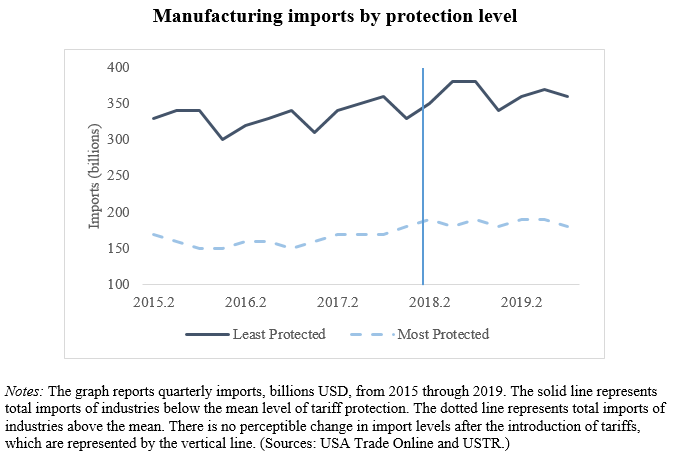

Tariffs did very little to interrupt import flows in either 2018 or 2019. For most industries, trade continued as normal and costs were passed on to customers.

Manufacturing was not the driver of economic growth in 2019. Arizona enjoyed positive overall GDP growth in 2019. However, this was driven mainly by strong performance in services and non-traded industries. Manufacturing growth was more modest.

Arizona’s manufacturing is concentrated heavily in Maricopa and Pima counties. The potential benefits of manufacturing tariffs ought to be concentrated in specific portions of the state.

Tariffs did not boost job growth. In 2019, neither jobs nor wages grew any faster in protected industries. This pattern holds nationwide as well as in Arizona and in Pima County.

Pima County’s economic performance is consistent with nationwide trends. Tariffs affecting many of Pima County’s main industries did not have a positive effect on jobs or wages.

In sum, there is very little evidence that tariffs benefit manufacturing workers. Neither jobs nor wages are correlated with trade protection. Note that this report is focused on imports and, as such, does not assess the impact of trade retaliation. In practice, the costs of trade protection are much higher. There is anecdotal evidence to suggest that responses from Beijing hurt key U.S. industries—not least, America’s farmers.

None of this diminishes the very real challenges facing the U.S. economy. Manufacturing job losses have to be taken seriously as an economic and social policy problem. However, tariffs are an incomplete—if not “wrong”—solution. U.S. competitiveness needs to be boosted by deeper investments at home. This includes investment in higher education, which has been systematically de-funded since the Great Recession. At the same time, the U.S. needs to build a coalition of like-minded trade partners. Many countries share an interest in confronting unfair trade practices. There is no need to go it alone through costly tariffs.

The conclusions in this report have to be understood in context. There are only about 18 months of employment and wage data to analyze from the start of tariff hikes until the COVID-19 pandemic caused historic disruptions in the US labor market. Those 18 months do not provide enough time to observe the lasting costs and benefits of tariff protection. Moreover, any analysis of employment and wages is limited by the large amount of undisclosed data within narrow industry categories. Those two caveats aside, this analysis shows that tariffs failed to result in a broad, short-term increase in the economic welfare of manufacturing workers.

References:

1. United States Bureau of Labor Statistics (BLS). “All employees, Manufacturing.” Data series MANEMP, retrieved from Federal Reserve Bank of St. Louis. Available at: https://fred.stlouisfed.org/series/MANEMP (accessed June 10, 2020).