Analyze Housing Cost Burden Rates in Tucson, Arizona MSA

Analyze Housing Cost Burden Rates in Tucson, Arizona MSA

How are we doing?

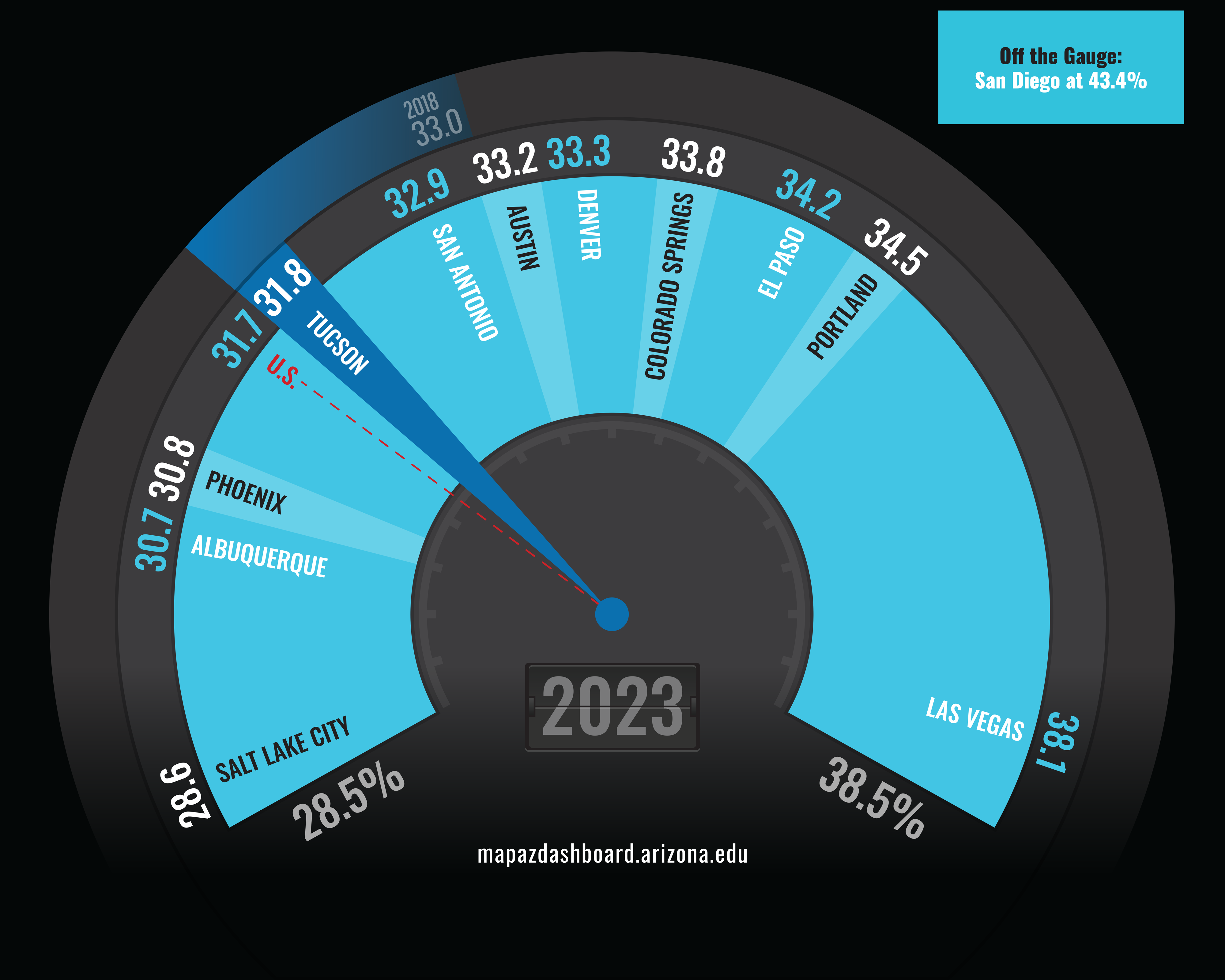

Percent of Housing Cost Burdened Households (2023)

The percent of households that were housing cost-burdened across the 12 Metropolitan Statistical Areas (MSAs) varied widely in 2023. Tucson had the fourth lowest housing cost burden rate among peer metropolitan areas at 31.8%. Housing cost burden ranged from 43.4% in San Diego to 28.6% in Salt Lake City. The Tucson MSA fared reasonably well, with 31.8% or 132,943 households paying more than 30% of their income in housing costs. Renters pay substantially more of their income in housing costs than homeowners in Tucson, Arizona, and the U.S. Renters have experienced an increasing percentage of their income going to housing costs since 2000.

Why is it important?

Historically, housing expenditures (including utilities) for both homeowners and renters that exceed 30 percent of a household’s income are considered cost-burdened, this designation evolved from the United States National Housing Act of 1937. Households that are cost-burdened are more likely to struggle to pay for other basic needs such as healthcare, childcare, transportation, and even food.

How do we compare?

When comparing household tenure, renters are more likely than owners to be cost-burdened. In the Tucson MSA during 2023, 21.4% of owners and 52.4% of renters were housing cost burdened, that was consistent with the state and the nation.

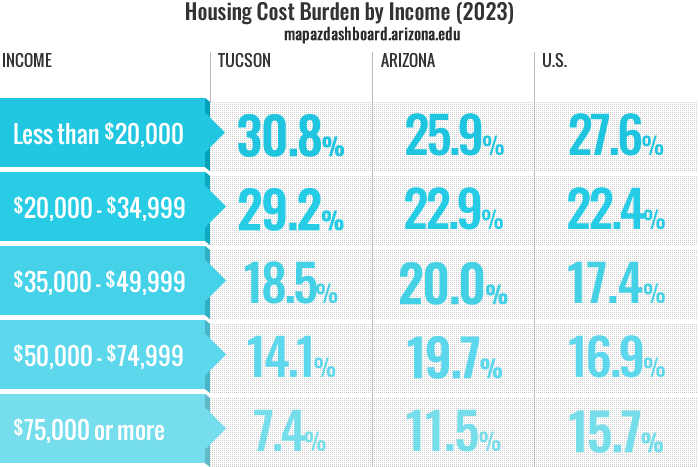

Income levels play a significant role in determining the percentage of households that are housing cost-burdened. As one would expect, households that have lower income are more likely to experience housing cost burden. In Tucson, of the households that earn less than $20,000, 30.8% of them pay more than 30% of their income in housing costs. This was significantly higher than those earning less than $20,000 throughout the state of Arizona which had a housing cost burden rate of 25.9%. It was also higher than the national rate of 27.6%. At the other end of the spectrum, only 7.4% of those households that earned $75,000 or more were housing cost-burdened in Tucson, while the rate increased to 11.5% for the state and was more than double for the nation at 15.7%.

In 2023, those aged 25 to 34 posted the highest percentage of housing cost-burdened households in Tucson at 24.9%, followed by those aged 65 and older at 22.7%. The U.S. had higher housing cost burden rates than Tucson for the 35 to 64 and 65 plus age groups. Tucson had the lowest housing cost burden rate for those 65 and older when compared to peer metropolitan areas.

What are the key trends?

The rate of households that were considered housing cost burden rose substantially between 2000 and 2009 in Tucson, the state of Arizona, and the U.S. for renters. Housing cost burden rates for renters leveled off between 2009 and 2018 and ticked upward in 2023. Tucson has consistently posted higher rates of housing cost burden for renters than both Arizona and the nation for the past two decades. Housing cost burden rates among homeowners in Tucson have fallen by nearly five percentage points since 2009.

How is it measured?

Housing cost burden data are reported for homeowners that have a mortgage, homeowners that do not have a mortgage, and renters. Housing cost burden reflects those households that pay greater than 30% of their income on housing costs, including utilities. Housing cost burden data are from the Census Bureau’s American Community Survey (ACS). The ACS is a nationwide rolling sample survey that produces one-year and five-year estimates on demographic, social, housing, and economic measures. All data provided in this analysis utilized five-year estimates. Note that the ACS five-year estimates are produced over a five-year time period and can only be compared to non-overlapping five-year estimates (for example 2006-2010 and 2011-2015).