There have been increasing concerns that the COVID-19 pandemic will cause an eviction crisis across the country. A recent report “The COVID-19 Eviction Crisis” published by the National Low Income Housing Coalition estimates that 30-40 million people in America could be at risk for eviction in the next few months. This is a particular concern for Arizona which already had high eviction rates before the pandemic began.

In late March, at the beginning of the pandemic, the Federal Government issued orders through the Coronavirus Aid, Relief, and Economic Security (CARES) Act to temporarily delay evictions of renters who were unable to pay their rent. While the temporary ban helped keep renters from being evicted it did not stop them from accumulating rental debt because they were still legally obligated to pay missed payments. The moratorium on evictions created by the CARES Act expired on July 31st, after which landlords could issue a 30-day notice for tenants to vacate properties.

Following the expiration of the CARES Act, the Center for Disease Control (CDC) issued a declaration on September 4th that temporarily halts evictions through the end of the year. The CDC notes that evictions of tenants could be detrimental to public health control measures that are in place to help slow the spread of COVID-19.

The CDC moratorium on evictions covers more households than the CARES Act. The CARES Act eviction moratorium for renters applied only to those who participate in federal housing assistance programs or live in a property with a federally backed mortgage. According to the Federal Reserve Bank of Atlanta, the moratorium on evictions from the CARES Act only covered between 28.1 to 45.6 percent of renter households.

Arizona’s Governor Doug Ducey also issued Executive Orders to delay the enforcement of evictions. His first order issued March 24th halted evictions for 120 days. Governor Ducey has since extended the moratorium on residential evictions until October 31st. The CDC moratorium overrides Arizona’s eviction ban set to expire on October 31st.

Prior to the COVID-19 pandemic, the state of Arizona had the highest eviction rate among western states at 3.9%, according to 2016 data from the Eviction Lab. The eviction rate is the number of homes that received an eviction judgement in which the renters were ordered to leave over the total number of occupied renting households in each region. The state of Nevada also had a high eviction rate, just behind Arizona at 3.4% (Figure 1). In 2016, Idaho had the lowest eviction rate at 0.6%, Washington and California followed closely with an eviction rate of 0.8%. Arizona’s eviction rate of 3.9% was more than six times the rate in Idaho and nearly five times the rate in Washington and California. Nationally, the eviction rate in the U.S. was 2.3% in 2016.

Figure 1: Eviction Rates (2016)

When exploring eviction trends since 2000, all western states, except Texas, posted eviction rates that were lower in 2016 than during the early 2000s. Arizona and Nevada have posted the largest declines since 2000, with eviction rates falling by 2.9 and 3.8 percentage points, respectively (Figure 2). Idaho has consistently reported one of the lowest eviction rates among western states. The national rate has remained relatively stable ranging from 2.3% to 3.1%.

Figure 2: Eviction Rates

Limited data is available at the county or metropolitan level for evictions from Eviction Lab. They do, however, have data for the Tucson Metropolitan Statistical Area (MSA). The Tucson Metropolitan Statistical Area represents the same geographic region as Pima County. In 2015, the eviction rate for the Tucson MSA was 5.1%, which was 1.2 percentage points higher than the state and almost double the national rate (Figure 3). Tucson’s eviction rate has declined since 2000, from a high of 7.0% in 2005 to a low of 3.9% in 2014. The Eviction Lab has limited eviction data for cities and places located in the Tucson MSA region. To explore the more detailed data visit Eviction Lab.

Figure 3: Eviction Rates for Tucson MSA (Pima County, AZ)

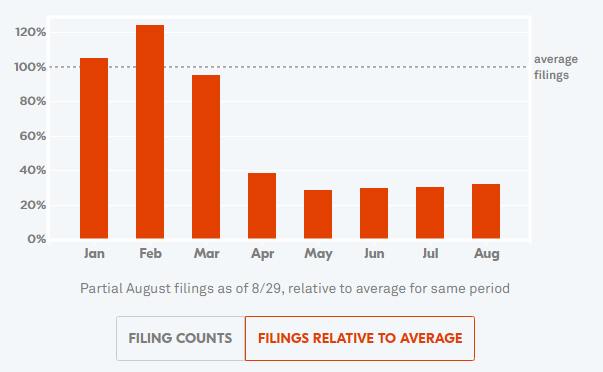

The Eviction Lab reports that filings for evictions in Maricopa County have fallen sharply since April when a temporary eviction ban went into effect (Figure 4). Note that the figure depicts total filings relative to the average for that month. Thus, filings in July 2020 were roughly 20% of normal for July. In addition, data used to create Figure 4 include all filings, not just those that have been processed and received a judgment. These data will be a key indicator to track as the temporary bans are lifted on evictions.

Figure 4: Monthly Eviction Filings Relative to Average for Maricopa County

*image courtesy of the Eviction Lab website for Maricopa County

*image courtesy of the Eviction Lab website for Maricopa County

The moratorium on evictions has temporarily allowed renters to stay in their homes. However, they are still legally responsible for any rental debt they accumulate during this time. It will be important to track evictions as the moratorium on evictions is lifted.

Also, the moratorium on evictions has had consequences that extend beyond renters. According to a recent report by the Brookings Institute, “An eviction moratorium without rental assistance hurts smaller landlords, too”, finds that 40% of residential property units are owned by individual investor landlords. Further, they find that among those owning residential investment properties, roughly a third are from low-to-moderate-income households which rely on rent for up to 20 percent of their total household income.

Stay tuned to the MAP Dashboard for an update on eviction data and additional analysis on housing as the moratorium expires and more data becomes available. An additional resource at the University of Arizona is “The Cost of Eviction Calculator” developed by a group of students in the Innovation for Justice Center at the James E. Rogers College of Law. The eviction calculator allows you to estimate the cost of eviction for your community. Their work builds on existing eviction cost literature.