Estimating the Cost of a House in Tucson, Arizona MSA

Estimating the Cost of a House in Tucson, Arizona MSA

Have you ever wondered how much house you can afford? Households that spend more than 30 percent of their income on housing-related expenses are considered housing cost-burdened. In 2021, 31.6% of households in Tucson were housing cost-burdened. That rate falls to 21.3% if you consider only homeowners, while 51.2% of renters were cost-burdened. Compared to peer western Metropolitan Statistical Areas (MSAs), Tucson fared relatively well in housing cost burden rates among homeowners. Figure 1 illustrates that Tucson’s rate of 21.3% was the third lowest, tied with San Antonio, and only one-tenth of a percent behind Phoenix.

Figure 1: Percent of Homeowners that are Housing Cost Burdened (2021)

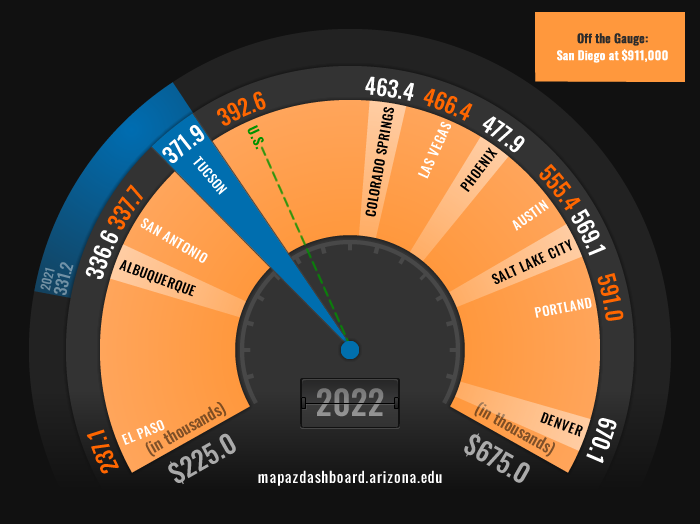

Housing cost burden rates are influenced by local home prices and income levels. Regions with high wages and low home prices tend to have low housing cost burden rates. Tucson’s low housing cost burden rate among homeowners was, in part, due to its relatively low home prices (compared to peers). Figure 2 highlights the median home price for single-family homes sold in the Tucson MSA in 2022. Tucson had the fourth lowest price among peers.

Figure 2: Median Home Price (2022)

However, home prices have increased rapidly over the past few years, far outpacing income gains in Tucson. Rapidly rising home prices, combined with spiking interest rates, have a direct impact on housing affordability and housing cost burden rates. You can find more information on this in the recent article Housing Affordability Plummets in 2022.

While there is plenty of data on the median home sales price for a metropolitan area, it takes more work to determine the price of an affordable home. There are several factors driving affordability. The most significant influences include the buyer’s monthly income, the amount of the down payment, and interest rates. Other factors which vary from region to region are local real estate taxes and insurance rates. Using local area taxes, and a fixed set of assumptions, we can calculate the price at which someone earning the local family income can afford to buy a house without being housing cost-burdened.

When comparing Tucson to peer MSAs, the local median family income ranged from $56,000 to $112,000. Using each MSAs respective median family income, we can calculate the maximum amount someone could afford to spend each month on their mortgage payment without being considered housing cost-burdened. A family in Denver could spend up to $2,796, followed closely by Austin at $2,726 (Figure 3). A family earning the local median income in El Paso had the lowest amount they could spend at $1,405.

Figure 3: Maximum Monthly Amount for a Mortgage without Housing Cost Burden

Given those income levels, what would an affordable house cost? In Tucson, if someone earns the local median family income, puts 20% down on their home, and finances the remaining amount for 30 years using the average mortgage interest rate in the fourth quarter of 2022 (6.66%), they could afford to purchase a house costing up to $306,400 without being considered housing cost-burdened. That would result in a monthly mortgage payment of $1,916, which includes principal and interest ($1575), taxes ($266), and homeowner insurance ($75).

Using each MSA’s local median family income and the same assumptions the affordable house price varied widely among the peer MSAs. Families in Denver had the highest purchase price at $487,500, while El Paso had the lowest at $193,200 (Figure 4).

Figure 4: Purchase Price of a Home without Housing Cost Burden with 20% Down Payment

The affordable house price drops significantly if families use a down payment of 10%. In Tucson, a family with the median income could afford to spend up to $259,600 without being considered housing cost-burdened. That would result in a monthly mortgage payment of $1,916, which includes principal and interest ($1,501), taxes ($225), homeowner insurance ($75), and mortgage insurance ($115). When compared among peers, Tucson had the fourth-lowest purchase price using these assumptions (Figure 5).

Figure 5: Purchase Price of a Home without Housing Cost Burden with 10% Down Payment

Check out the recent articles exploring the decline in housing affordability and how housing cost burden rates vary among Southern Arizona Communities. Stay tuned to the MAP for upcoming articles on housing as more data on home prices, affordability, and interest rates become available.