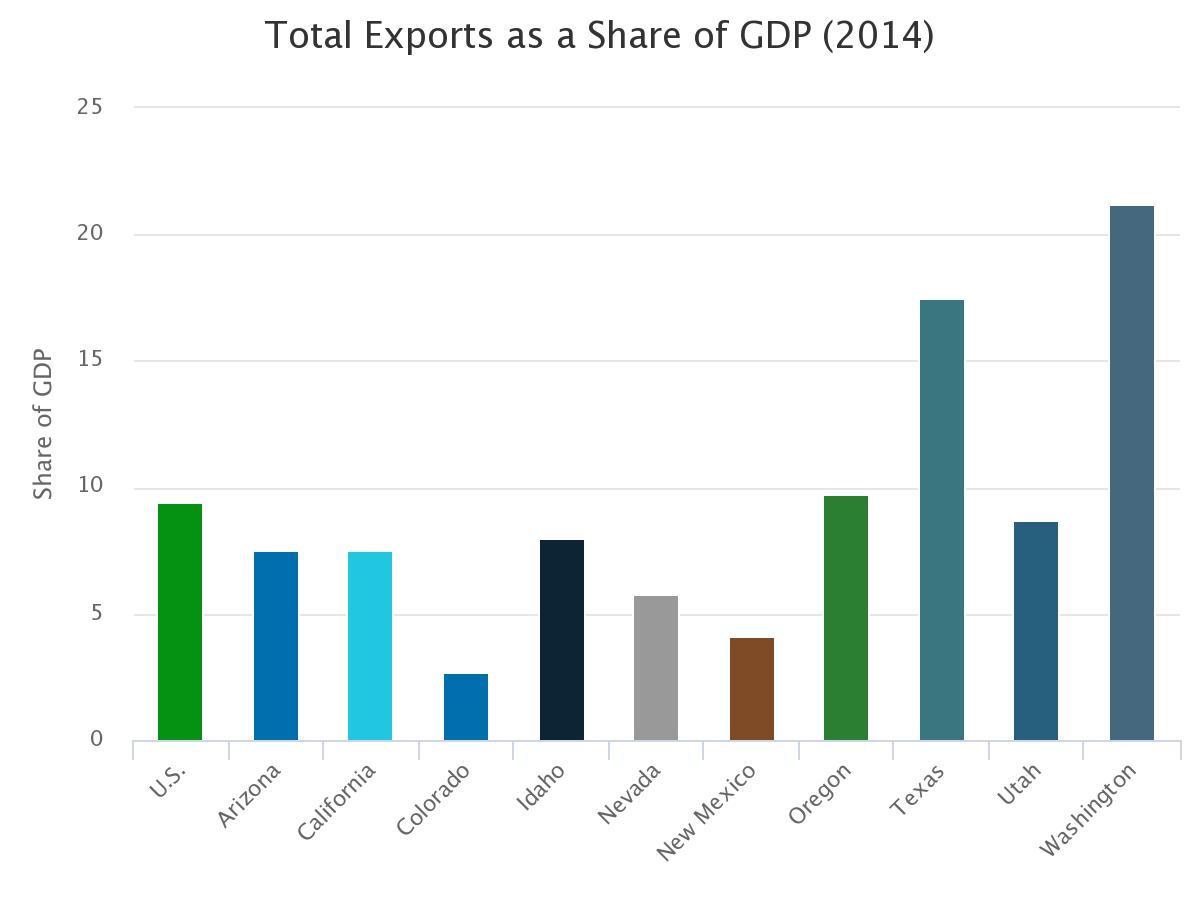

Recent export growth in Arizona confirms the importance of Mexico to local economic development. The state of Arizona posted a growth rate of 9.1% in total merchandise exports between 2013 and 2014, faster than the U.S. rate of 2.7%. Exports make up a significant portion of Arizona’s economy with Mexico, the largest destination. During 2014, Arizona’s exports accounted for 7.5% of the state’s Gross Domestic Product (GDP), equal to California and slightly less than the U.S. share of 9.4%. Arizona’s exports to Mexico reached $8.6 billion in 2014, this equaled 40.6% of total exports for the state. Arizona’s steady increase in exports since the Great Recession is a positive sign for the state’s economic recovery because international trade can be an important contributor to economic growth.

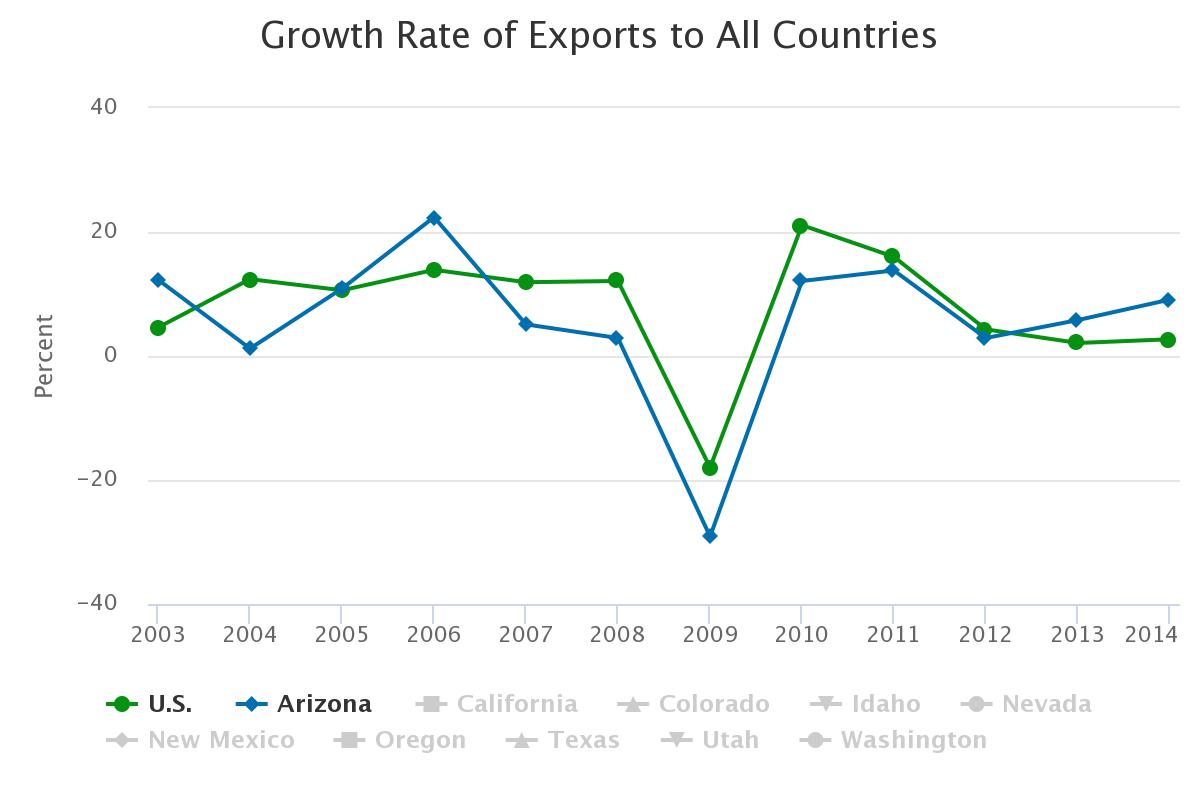

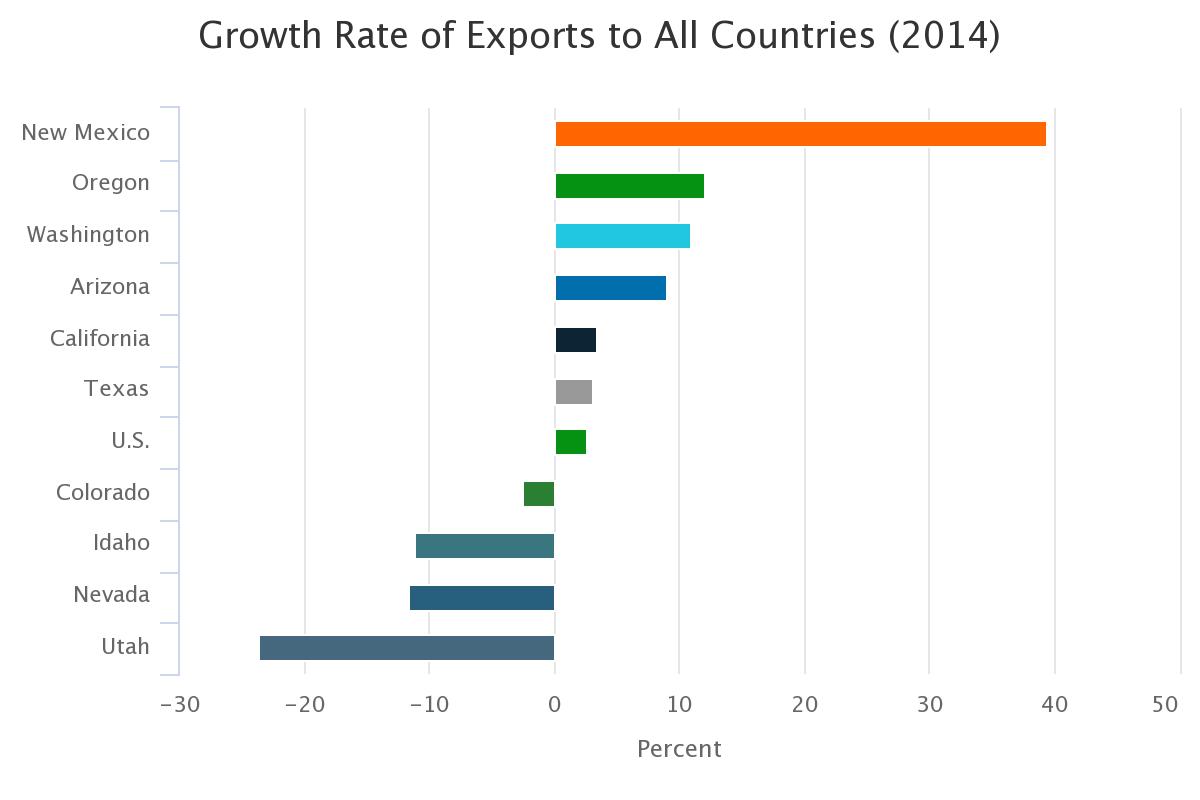

Arizona has posted strong growth in exports worldwide since the Great Recession with a rate more than triple the U.S. in 2014. Arizona’s recent growth rate of 9.1% in total exports ranked fourth among the 10 western states. New Mexico’s growth rate of 39.4% ranked first, while Utah ranked last with a decline in exports of 23.6%.

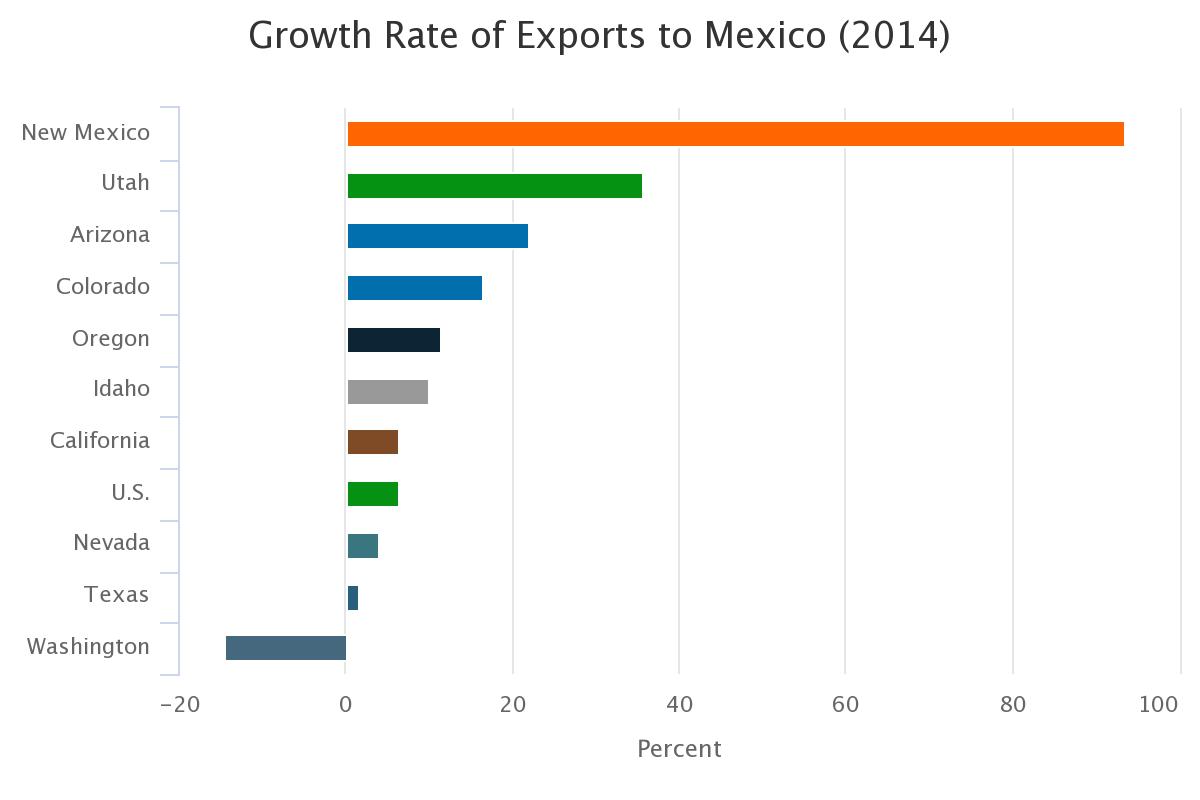

Arizona posted significant growth in exports to Mexico since the Great Recession with growth rates over 10% for all but one year. The current Arizona growth rate in exports to Mexico of 22.0% was almost four times the U.S. growth rate (6.3%) and ranked third highest among the 10 western states.

Exports play a big role in Arizona’s economy accounting for 7.5% of the state’s GDP in 2014. Of the 10 western states, Washington posted the largest percentage of exports as a share of GDP at 21.2%, while Texas was close behind at 17.5%. Several western states, including Arizona, had shares similar to the U.S. rate of 9.4%. Colorado’s exports as a share of GDP was the least of any of the 10 western states at 2.7%.

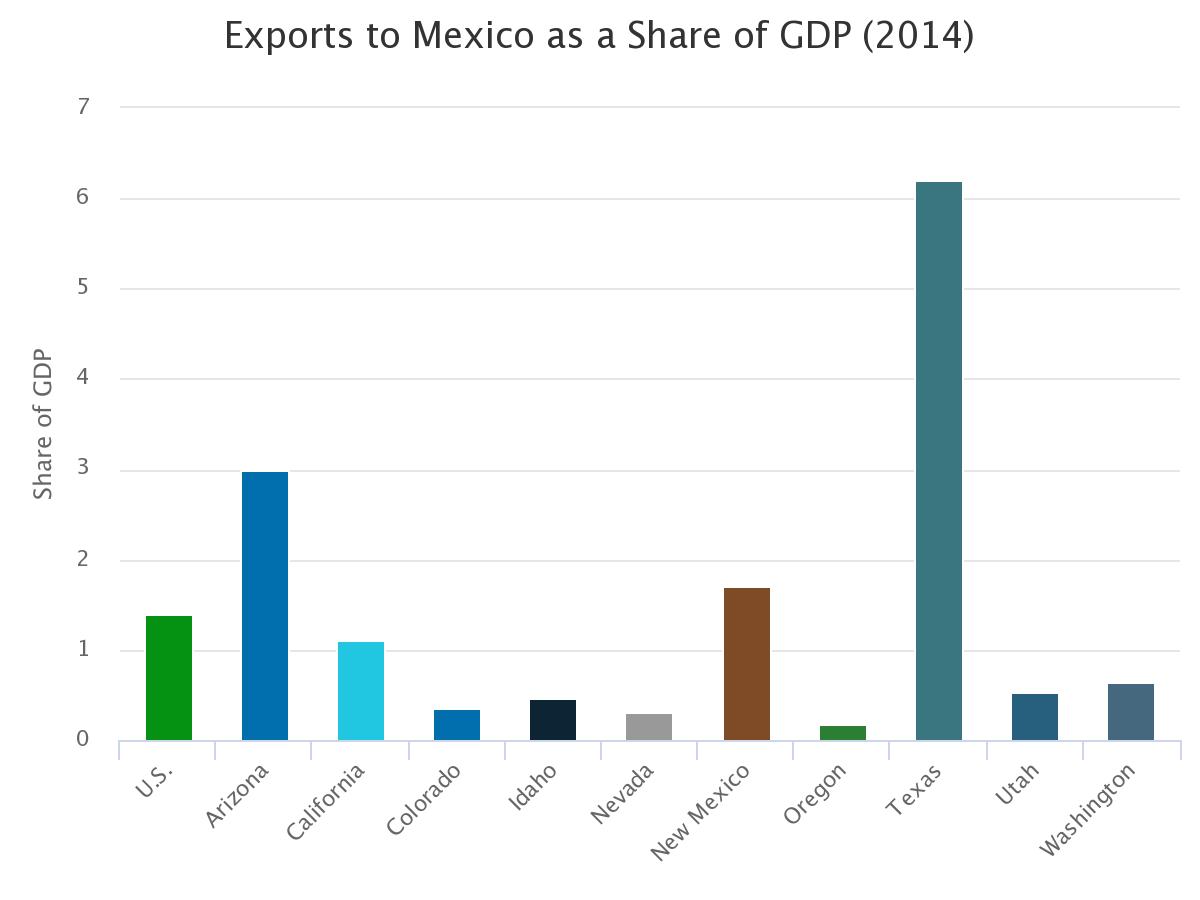

Mexico is the main destination for exports for several of the southwestern states. For example, nearly half of Texas’s exports are sent to Mexico. Likewise, Arizona sends 40.6% of its exports to Mexico. Arizona had the second largest percentage of exports to Mexico as a share of GDP at 3.0%, more than 3.0 percentage points behind Texas, but substantially ahead of all the other western States.

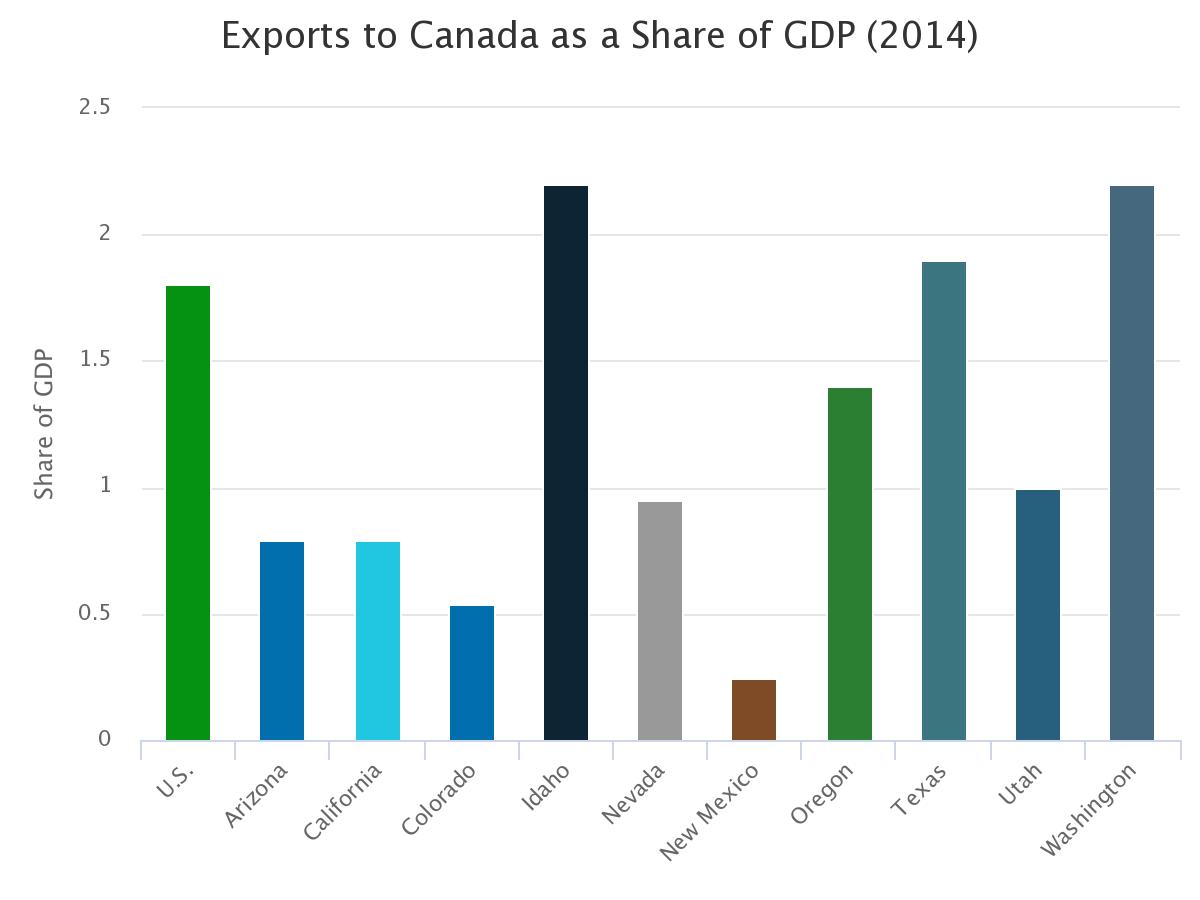

Two of the western states used for comparison border Canada. As with the southern states that border Mexico, one would expect a large percentage of exports to be sent to neighboring countries. This holds true for the northern states of Idaho and Washington with exports to Canada accounting for over 2.0% of GDP. Likewise, the states that border Mexico (Arizona, California, New Mexico, and Texas) all post the highest percentage of exports to Mexico as a share of their GDP.

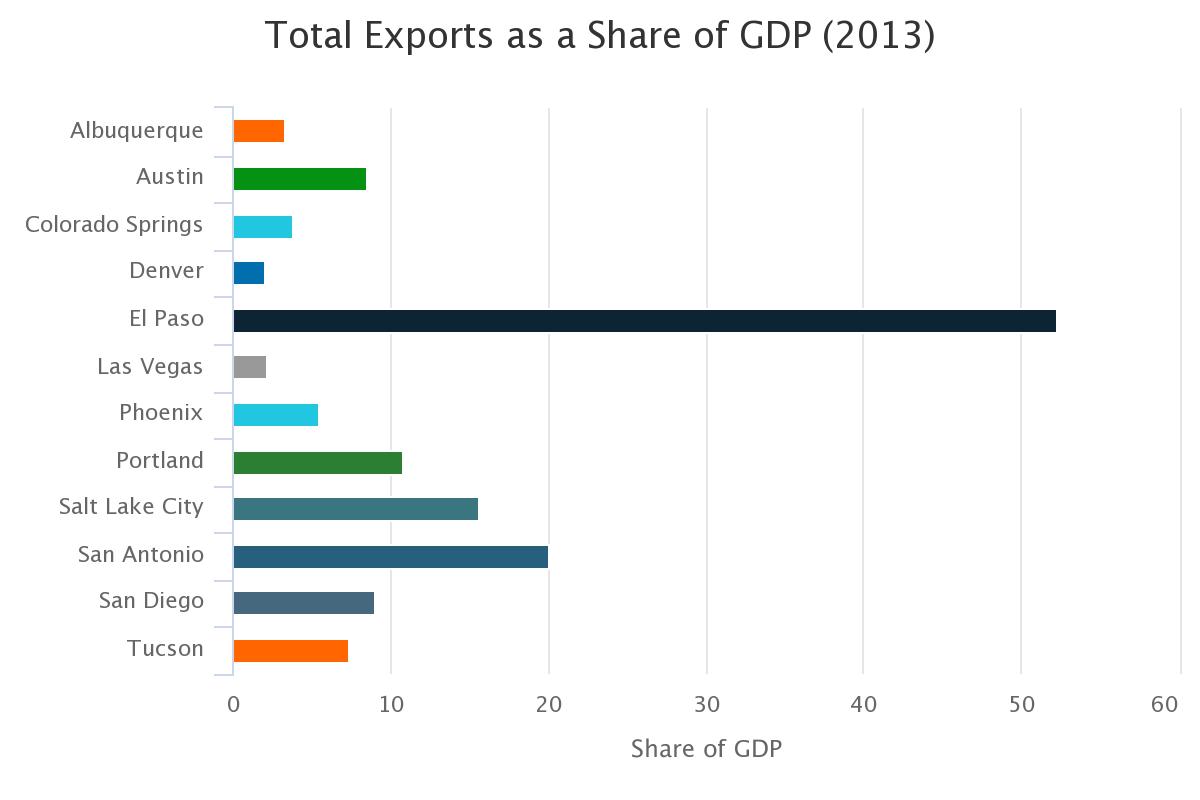

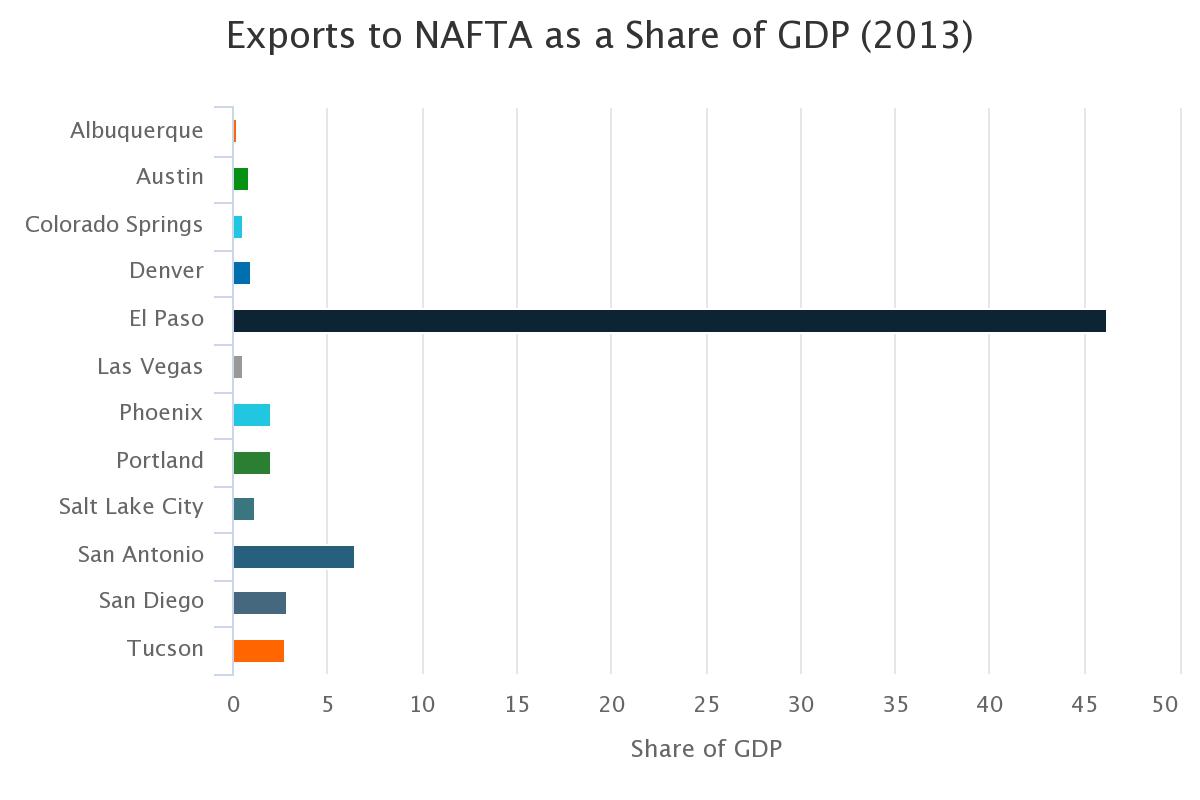

In 2013, Tucson’s exports as a share of GDP was 7.3%. El Paso posted the largest share of GDP from exports at 52.3%, while Denver the least (2.0%). Export data for Metropolitan Statistical Areas (MSAs) is broken down by region rather than Country, therefore for MSAs we explore exports to the North American Free Trade Agreement (NAFTA). NAFTA includes the United States, Canada, and Mexico. Tucson’s exports to NAFTA countries accounted for 2.8% of GDP, similar to San Diego but less than San Antonio or El Paso. Tucson’s growth in exports between 2010 and 2013, since the Great Recession, has remained positive in both exports worldwide and to NAFTA countries. Similar to the state of Arizona, exports play a large role in Tucson’s economy accounting for more than 7.0% of GDP. Stay tuned for a more detailed and updated analysis on MSA exports available this fall when the 2014 GDP data has been released.

To learn more about trade in Arizona please visit the University of Arizona Economic and Business Research Center's Arizona-Mexico Economic Indicators webpage.