How did the Tucson economy perform last year? Compiling and summarizing all the relevant data can be daunting. However, the MAP Dashboard makes the process quick and informative. From the Dashboard, we know that the Tucson economy improved in 2016, with job and population growth accelerating from the more modest pace of 2015. Indeed, Tucson added 4,700 jobs over the year in 2016, which translated into a 1.3% growth rate. That was far faster than the 0.8% rate posted in 2015 and was our fastest pace since 2012. In addition, Tucson added 3,700 residents last year, for 0.4% growth.

Within the Employment Growth by Industry category, you can drill down to explore Tucson’s job growth by industry. Overall, Tucson’s job growth last year was driven primarily by health services, leisure and hospitality, and manufacturing. The job growth in manufacturing, spurred by aerospace hiring, was particularly encouraging because wages in that sector tend to be much higher than average. In 2015, manufacturing wages, excluding fringe benefits, averaged $81,576 per worker, compared to the all-industry average of $43,620.

Tucson lost jobs last year in the natural resources and mining sector, as well as, in trade, transportation, and utilities. Weak commodity prices continued to weigh on copper production in Tucson, resulting in job losses in mining. Indeed, copper prices fell 12.2% in 2016 and were down 44.6% from 2011. Weakness in trade, transportation, and utilities reflected losses in transportation and warehousing and in retail trade. Retail jobs are being affected by structural changes in the industry (brick-and-mortar stores face increased competition online) and by the likely impacts of a strong dollar on international visitor spending. Without job losses in these two sectors last year, Tucson’s job growth would have been 1.5%.

Construction jobs rose by 300 last year, reflecting in part stronger residential building activity. Most other sectors posted only small employment increases or remained roughly stable.

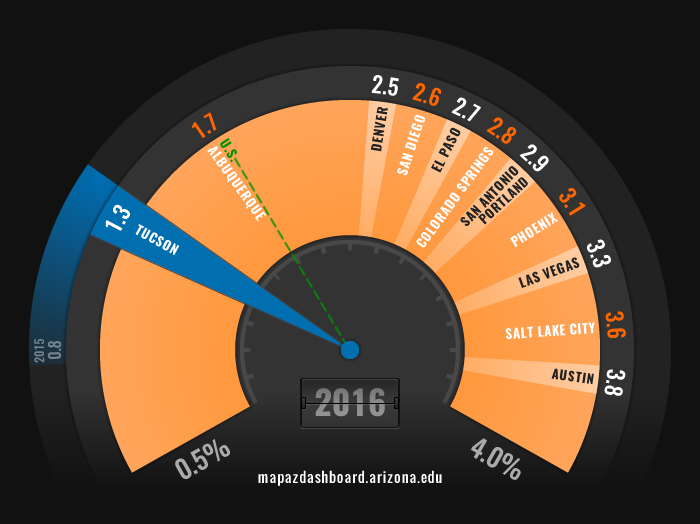

While local job growth accelerated last year, it remained well below the state and national pace. Arizona increased jobs at a 2.6% pace last year, while the national rate hit 1.7%. Tucson’s job growth was also slow relative to the other metropolitan areas tracked on the Dashboard. For instance, the Phoenix metropolitan area added jobs at a 3.1% rate, more than double that of Tucson. The story was similar for local population growth. See Figure 1 to compare Tucson's employment growth to the other metropolitan areas tracked on the Dashboard.

Figure 1: Growth Rate of Total NonFarm Employment (2016)

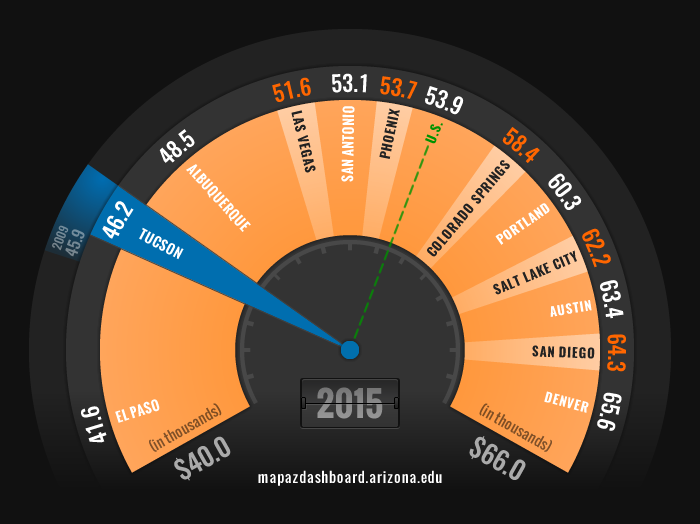

Median household income for the Tucson metropolitan area hit $46,162 according to the 2015 five-year estimate from the American Community Survey. That ranked Tucson 11th out of the 12 western metropolitan areas tracked on the Dashboard and was 14.3% below the national level of $53,889. Not good performance there. To explore Tucson compared to other metropolitan areas on the Dashboard see Figure 2 below.

Figure 2: Median Household Income (2015)

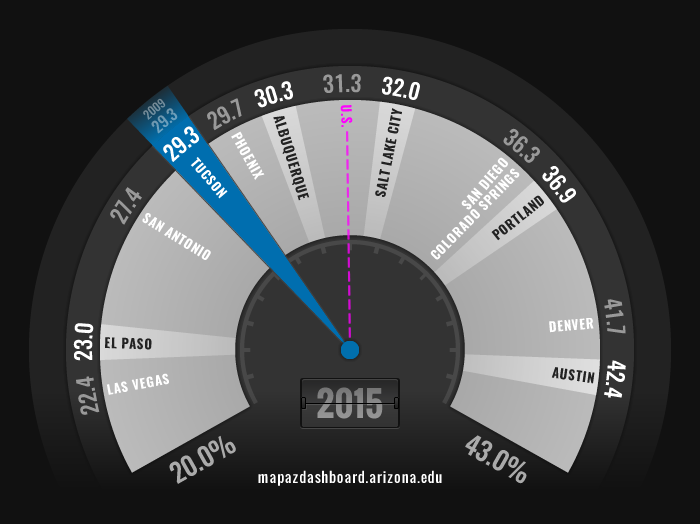

One key driver of local prosperity is educational attainment. States and local areas with higher shares of highly educated residents tend to generate faster income growth than areas with lower shares. Tucson’s four-year college attainment rate for the working-age population (age 25-64) was 29.3%, according to data released for 2015. That was below the national average of 31.3%. Tucson ranked ninth out the 12 metropolitan areas on the Dashboard, far below Austin, at 42.4%, and Denver, at 41.7%. This educational attainment gap is a key concern for Tucson because better educated metropolitan areas are likely to be more innovative, productive, and competitive. Figure 3 illustrates how Tucson compared to the metropolitan areas explored on the Dashboard.

Figure 3: Four-Year College Attainment Rate for the Working Age Population (2015)

Overall, Tucson’s performance improved last year. Further, there are good reasons to suspect that the local economy will continue to expand. In particular, the aerospace sector is expected to continue to add high paying jobs. This will contribute to faster income growth and higher median incomes.