Learn About the Cost of Living in Tucson, Arizona MSA

Learn About the Cost of Living in Tucson, Arizona MSA

How are we doing?

The cost of living in the Tucson Metropolitan Statistical Area (MSA) was 5.7% below the nation in 2023, ranking Tucson fourth among its peer western MSAs. The cost of living varied widely across the 12 comparison MSAs, with San Diego reporting a cost of living 11.5% above the U.S., while El Paso was 9.8% below. Tucson posted a modest rate of inflation between 2009 and 2021, averaging 1.2% per year. The state of Arizona posted a slightly lower rate of inflation with an average of 1.1%. However, inflation spiked in 2022 to 7.6% for Tucson and 10.3% for Arizona. Inflation dropped in 2023 but continued to be well above the 2009-2021 average, with Tucson and Arizona at 4.4% and 5.0%, respectively.

Why is it important?

The cost of living is measured by the Regional Price Parities (RPPs) which compare prices and living expenses across states and MSAs on a wide variety of items, including housing, food, and healthcare. The cost of living measure compares how expensive it is to live in one city or state versus another, allowing one to measure the monetary cost of maintaining a particular standard of living in various locations. This is an important factor when relocating and during wage negotiations. For example, the same salary may go far in a city with a low cost of living, but be insufficient in an expensive city. The Implicit Regional Price Deflator measures how a region’s prices change over time, thus providing a measure of inflation. The cost of living and the Implicit Regional Price Deflator both measure the buying power of a dollar but from different perspectives.

How do we compare?

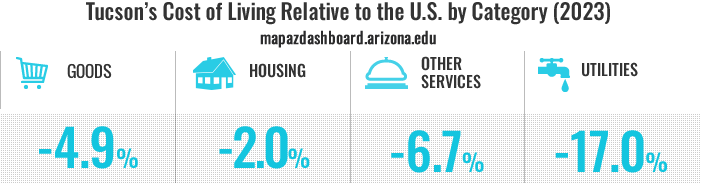

Data on the cost of living can be broken down into four major categories: Goods, Housing, Other Services, and Utilities. In 2023, the overall cost of living for Tucson was 5.7% below the U.S., while the cost of Housing in Tucson was only 2.0% below the U.S. The Housing category includes housing costs for both owners and renters. The Goods category reflects typical consumer expenditures on tangible items such as groceries, clothing, and vehicles. The cost of goods in Tucson was 4.9% below the nation in 2023. Tucson did much better compared to the U.S. in the Other Services and Utilities categories at 6.7% and 17.0% below the national average respectively. Other Services include items such as legal, health, and recreational services.

What are the key trends?

The Implicit Regional Price Deflator measures the rate of inflation over time. The Tucson MSA posted modest increases in inflation in 2009, 2011, 2012, 2017, 2019, and 2021 with rates of 3.1%, 3.8%, 2.4%, 2.8%, 2.0% and 2.8%, respectively. In 2022, the rate of inflation jumped to 7.6% for Tucson, which was below the state’s rate of 10.3%. Between 2009 and 2021 the inflation rate in Tucson averaged 1.2% per year, just slightly higher than the average rate of inflation for the state of Arizona. Inflation jumped significantly across the nation in 2022. Inflation declined in 2023 to 4.4% for Tucson and 5.0% in Arizona. That was still well above the year-over-year average between 2009 and 2021.

How is it measured?

The Bureau of Economic Analysis (BEA) calculates Regional Price Parities (RPPs) using data gathered for use in the Consumer Price Index. Major categories include housing, food, transportation, and education. Rent data and owner equivalent costs collected from the Census Bureau’s American Community Survey are also used in the construction of the RPPs. The expenditure weights for each category are constructed using data from the BLS Consumer Expenditure Survey and BEA Personal Consumption Expenditures. The RPPs are indexes that allow the comparison of prices across regions. RPPs are expressed as a percentage of the overall national price level for a given year, which is equal to 100. All expenditure classes (goods, rents, and other services) are compared to the U.S. total for all items. The Implicit Regional Price Deflator uses the same data but is adjusted to track price changes over time within a region.