How are we doing?

Median Home Price (2015)

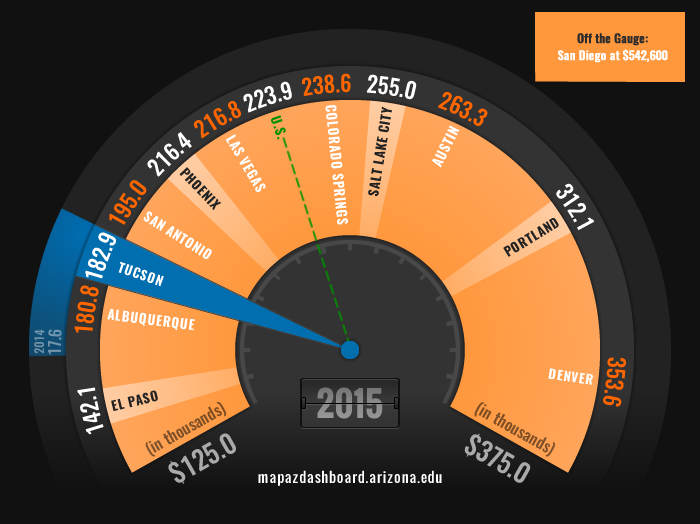

In 2015 the median sales price of existing single-family homes in the Tucson Metropolitan Statistical Area (MSA) was $182,900. When compared across 12 western metropolitan areas, Tucson had one of the lowest median home prices, with only El Paso and Albuquerque lower. San Diego had the highest median price for homes at $542,600. Tucson’s 2015 median sales price of $182,900 was 20.2% below the national median. Price fluctuations in Tucson between 2000 and 2015 followed roughly the same pattern as the nation but with a much steeper rise and fall; however, they were not nearly as volatile as prices in Phoenix.

Why is it important?

Home prices reflect supply and demand in the housing market which in turn can echo the general economic health of an area. Several factors can influence home prices, including mortgage rates and the business cycle. The home is the largest asset for most people, and the price of a home can affect spending in other areas. Since personal consumption makes up the better part of the economy, and discretionary income levels are influenced by the cost spent on housing, home prices are an important factor in the local economy.

What are the key trends?

Tucson MSA’s 2015 median sales price of $182,900 was 20.2% below the national median and 16.8% less than Phoenix. Home prices nationally began a distinct rise around 2005, peaking in 2006, followed by a drop beginning in 2008. Tucson home prices followed the same general pattern, but had a much steeper rise and fall. Median home prices bottomed out for Tucson in 2011, having fallen 45.1% from the peak in 2006, and have since risen 36.0% surpassing the prices seen in 2004 before the housing bubble. While Tucson price fluctuations were more prominent than that of the nation, they were not nearly as volatile as prices in Phoenix.

[[nid:345]]

How is it measured?

Median home price represents the sale price of existing single-family homes for which half the homes sold for more and half for less. These data come from the National Association of Realtors (NAR), which tracks and compiles existing home sales from local associations/boards and multiple listing services nationwide. The NAR differs from other measures that are designed to track repeat sales, such as the Federal Housing Finance Agency (FHFA) or S&P/Case-Shiller home price indexes, in that median home price can be strongly influenced by the mix of houses sold in an area.